Get the free atiga form d

Show details

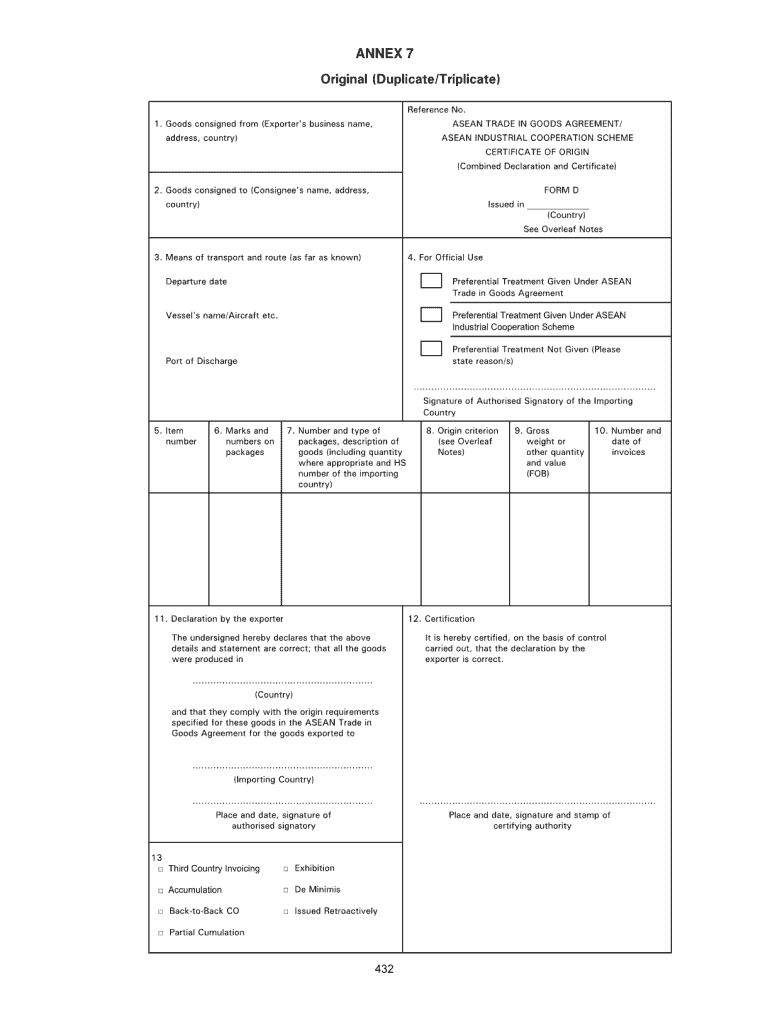

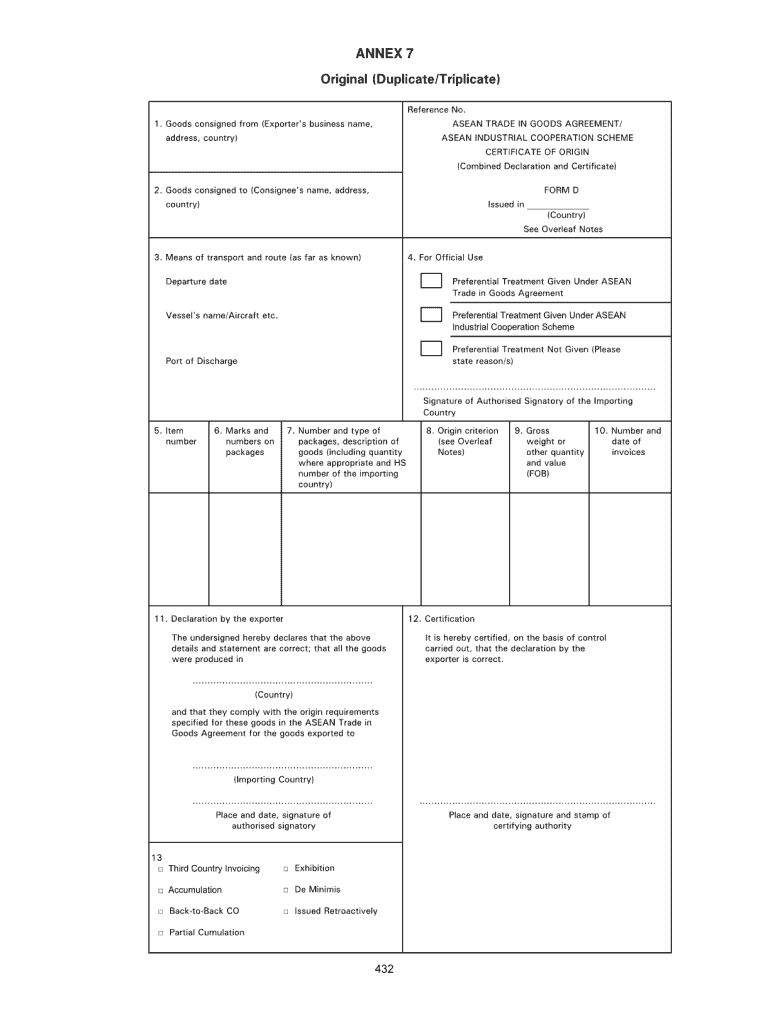

ANNEX 7 Original (Duplicate/Triplicate) Reference No. 1. Goods consigned from (Exporter's business name, address, country) ASEAN TRADE IN GOODS AGREEMENT/ ASEAN INDUSTRIAL COOPERATION SCHEME CERTIFICATE

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your atiga form d form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your atiga form d form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit atiga form d online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form d template. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out atiga form d

How to fill out required customs:

01

Gather all necessary documentation such as invoices, packing lists, and any other relevant paperwork.

02

Familiarize yourself with the customs regulations and requirements specific to the country you are shipping to.

03

Provide accurate and detailed descriptions of the goods, including quantity, value, and any special characteristics or features.

04

Ensure that the customs forms are filled out correctly, paying close attention to accuracy and completeness.

05

Include all required information, such as the shipper's and recipient's details, commodity codes, and harmonized system (HS) codes.

06

Declare the value of the goods accurately, including any applicable taxes or duties.

07

If necessary, provide additional documents or certifications, such as licenses or permits, to comply with the customs requirements.

08

Double-check all information before submitting the customs forms to avoid any errors or omissions.

Who needs required customs:

01

Individuals or businesses involved in international trade or shipping goods across borders.

02

Importers and exporters who need to comply with the customs regulations of the countries involved in the transaction.

03

Freight forwarders, shipping agents, or customs brokers who handle the customs clearance process on behalf of their clients.

Fill form d blank form : Try Risk Free

People Also Ask about atiga form d

How do I fill out a US customs form?

Why do I have to fill out a customs form?

Is the U.S. customs form no longer needed?

Do I need to fill out a US customs form?

What requires a customs form?

How do I know if I need a customs form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is required customs?

Customs is the process of collecting taxes and duties on goods that are imported and exported from countries. Customs also applies to individuals travelling to another country with goods they wish to take abroad, such as personal items, gifts, and souvenirs. Customs regulations vary from country to country, so it is important to become familiar with the specific regulations of the country you plan to visit.

What information must be reported on required customs?

When filing a customs declaration, the following information must be reported: the name and address of the importer and/or exporter, a detailed description of the goods being imported or exported, the country of origin of the goods, the quantity and value of the goods, the mode of transport, the Harmonized System (HS) Code, and any applicable taxes or duties.

When is the deadline to file required customs in 2023?

The deadline to file required customs in 2023 will be determined by the individual country or region. Generally, the deadline to file customs declarations is within a few days of the goods entering the country.

Who is required to file required customs?

Any person or entity engaging in international trade and crossing the international borders is generally required to file required customs documents. This includes importers, exporters, customs agents, freight forwarders, or any party involved in the movement of goods across the borders. The specific requirements and documents to be filed may vary depending on the country and the type of goods being imported or exported.

What is the penalty for the late filing of required customs?

The penalty for the late filing of required customs documentation can vary depending on the country's customs regulations and the specific circumstances of the late filing. In general, late filing can result in monetary penalties, which are often calculated as a percentage of the value of the goods being imported or exported. The specific amount of the penalty can vary and may be subject to additional factors such as the frequency and severity of the late filing. It is advisable to consult with customs authorities or a customs broker to understand the precise penalties and consequences for late filing in a specific jurisdiction.

How to fill out required customs?

When filling out customs forms, it is important to provide accurate and complete information about the items being shipped internationally. Here are some general steps to fill out the required customs paperwork:

1. Obtain the appropriate form: Depending on your country and the destination country, you may need to fill out specific customs forms. These forms are usually available online or at your local post office or customs office.

2. Part 1: Sender/Shipper Information: Provide your full name, address, and contact information in the designated section. This will help customs officials to contact you if any clarification is needed.

3. Part 2: Recipient Information: Fill in the recipient's full name, address, and contact information. Ensure clarity and accuracy to avoid any delivery issues.

4. Part 3: Shipment Details: Provide a detailed description of each item being shipped. Include the quantity, a brief description of the item(s), and their value. Be specific and include any relevant details like brand, model, or serial numbers if required.

5. Part 4: Declaration and Value of Contents: Acknowledge the accuracy of the information provided and sign the form. If necessary, indicate whether the contents are for commercial purposes or personal use. Declare the total value of the items being shipped accurately to avoid delays or penalties.

6. Part 5: Additional Information or Documentation: Some customs forms may have a section for additional information or require supporting documentation such as invoices, receipts, or certificates. Ensure that you have these documents ready and attach them if required.

7. Review the Form: Double-check all the information you provided before submitting the form. Make sure that all sections are complete, accurate, and legible.

8. Submitting the Form: Depending on the shipping method chosen, you may need to submit the customs form to your shipping carrier, post office, or directly to customs officials. Follow the instructions provided by your shipping service provider.

9. Pay any applicable fees: There may be customs fees or duties associated with your shipment. Be aware of any additional charges and ensure that they are paid in a timely manner to avoid delays in the customs clearance process.

Remember, customs requirements may vary depending on the country and the type of items being shipped. If you are unsure about how to fill out specific customs forms or need further assistance, consider consulting a customs broker or reaching out to your shipping carrier for guidance.

How can I modify atiga form d without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including form d template, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I sign the form d atiga electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your required customs in seconds.

How can I edit consignee consignment on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing goods agreement cooperation scheme certificate origin form, you need to install and log in to the app.

Fill out your atiga form d online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form D Atiga is not the form you're looking for?Search for another form here.

Keywords relevant to form d

Related to c0 d ga

If you believe that this page should be taken down, please follow our DMCA take down process

here

.